Bank of Ireland Personal Loans turn your plans into reality

Bank of Ireland Personal Loans offer a smart and practical way to access financing for personal goals—whether it’s a dream wedding, home improvements, or a well-deserved holiday.

With competitive rates and a seamless application process, Bank of Ireland stands out for its reliable service, flexible terms, and focus on customer satisfaction. Let’s uncover the full potential of this lending solution tailored to your needs.

Anúncios

- APR: 7.1% APR (for loans between €20,000 – €75,000)

- Loan Purpose: Personal expenses, such as holidays, weddings, big purchases

- Loan Amount: Between €2,000 and €75,000

- Credit Score Requirement: Based on creditworthiness and financial info provided

- Origination Fee: No arrangement or deposit fees

Details herein are sourced directly from the official Bank of Ireland website.

Loan

Bank of Ireland Personal Loans

The essence of Bank of Ireland Personal Loans

Bank of Ireland Personal Loans offer a wide borrowing range between €2,000 and €75,000, making them ideal for both modest and substantial financial needs without requiring collateral.

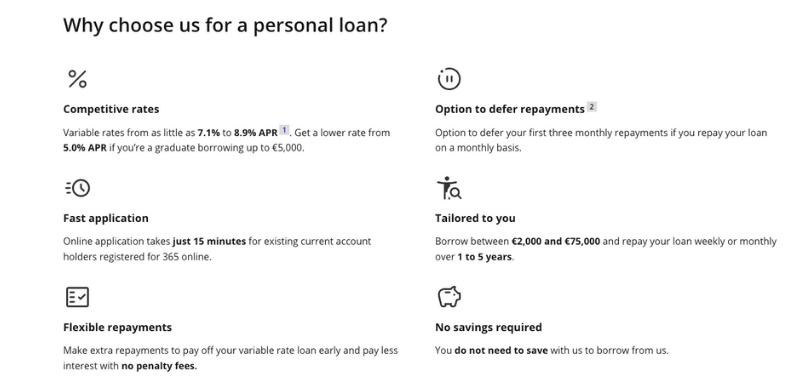

Interest rates range from 7.1% to 8.9% APR, depending on the amount borrowed and your financial profile. Graduate borrowers can qualify for even lower rates starting from 5.0% APR.

Flexible repayment terms from 1 to 5 years allow you to manage your repayments in a way that suits your lifestyle, either monthly or weekly.

There’s also an option to defer your first three monthly repayments, giving some breathing room before you start paying back your personal loan Ireland.

Weighing the scales of Bank of Ireland Personal Loans: a look at its advantages and disadvantages

Bank of Ireland Personal Loans offer compelling features for those seeking reliable personal financing, but as with any financial product, it’s important to weigh the benefits and potential drawbacks carefully:

The advantages that Bank of Ireland Personal Loans brings to you

- Attractive APR for higher loan amounts: Borrowers requesting between €20,000 and €75,000 can benefit from an APR as low as 7.1%, which is competitive for personal loans in Ireland.

- No arrangement fees or hidden charges: Bank of Ireland doesn’t require deposits or arrangement fees, ensuring that your loan costs are fully transparent from the beginning.

- Fast and efficient online application process: Existing customers using the 365 online platform can apply in just 15 minutes, making the loan application process quick and accessible.

- Flexible repayment structure: Choose to repay weekly or monthly over a period from 1 to 5 years, allowing the loan to adapt to your income schedule and financial planning.

- Optional deferred repayments for the first three months: You can opt to delay your first three monthly repayments—ideal if you’re managing short-term cash flow before starting regular payments.

- No penalty for early repayment on variable rate loans: If you decide to pay off your loan earlier than scheduled, you can do so without incurring any additional charges on variable-rate agreements.

- Loans available from as low as €2,000: Whether you’re funding a small project or a major expense, Bank of Ireland lets you borrow from €2,000 up to €75,000 depending on your needs.

- No requirement to have savings with the bank: Customers don’t need to maintain a savings account or history with Bank of Ireland to qualify for a personal loan Ireland.

Points to consider regarding Bank of Ireland Personal Loans

- Loan approval depends on credit assessment and documentation: Approval is not guaranteed and depends on your financial background. A credit report will be requested for loans over €500.

- Interest rates vary based on loan amount and financial profile: While APR can start at 7.1%, smaller loans (under €10,000) may attract higher rates up to 8.9%, depending on your creditworthiness.

- Deferred repayment increases the total interest paid: Choosing to delay the first three payments means you’ll end up paying more interest over the life of the loan.

- Eligibility restricted to existing current account holders for online applications: To apply online, you must already hold a Bank of Ireland current account and be registered for 365 online services.

- Graduate loan eligibility limited to specific criteria: To access the lower 5.0% APR rate, you must have a graduate current account and be in employment or have a signed job offer.

- Fixed-rate loans may incur fees for early repayment: Although variable-rate loans offer penalty-free early repayments, fixed-rate loans may involve charges if you pay off the loan early.

- Loan drawdown must occur within 30 days: Once approved, you must draw down your loan within 30 days, or you’ll need to submit a new application.

- No secured loan option available: All loans are unsecured, meaning your eligibility will rely entirely on your personal creditworthiness and financial profile.

Ready for Bank of Ireland Personal Loans? Here’s your starting point!

Applying for Bank of Ireland Personal Loans is straightforward, but it’s essential to understand who qualifies and what steps to follow for a smooth application. Let’s see it:

Who’s eligible to apply? Find out if you qualify

To apply for a Bank of Ireland Personal Loan online, you must be aged 18 or over and reside in the Republic of Ireland as a legal resident.

You must also be an existing Bank of Ireland current account holder and be registered for 365 online banking services to complete the online loan application process.

Additionally, graduate loan applicants must hold a Bank of Ireland graduate current account and be employed or have a signed job offer, meeting all lending criteria and terms.

Choose your route: the available options for requesting Bank of Ireland Personal Loans

Apply online via the Bank of Ireland website—existing customers with a 365 online profile can complete it in just 15 minutes. It’s fast, secure, and convenient.

Call the bank of ireland loans team at 0818 200 334 (Monday to Friday, 9am–5pm) if you’re a new customer or have unique circumstances needing personal support.

You can also contact the bank of ireland personal loan contact team via the 365 online message service. Log in, select Services, and send your query directly.

Prefer face-to-face? So, visit your local branch to speak with a lending advisor. This is ideal if you want guidance or have complex loan needs.

Heading towards Bank of Ireland Personal Loans: understanding the step-by-step process

Have you decided that you want to apply? Let’s look at the processes in detail:

- Start by using the personal loan calculator to get a repayment estimate. Then, complete your loan application online or through another channel.

- Submit the required documents, including proof of PPSN and your 365 user ID. If needed, the bank of ireland loans team will follow up for more info.

- Once approved, you’ll have 30 days to draw down your loan. Funds are deposited directly into your account, and repayment starts based on your chosen schedule.

Loan

Bank of Ireland Personal Loans

Considering more resources: financial alternatives such as AIB Personal Loans

While Bank of Ireland Personal Loans offer excellent terms and fast online applications, it’s always wise to explore additional lending solutions to find the best fit for your situation.

Another strong option is AIB Personal Loans, which provide fast approval times, flexible terms, and accessible application channels, especially for existing AIB customers seeking up to €75,000.

Both lenders serve personal finance needs such as home upgrades, holidays, or major purchases. Choosing between them depends on your eligibility, loan amount, and preferred application method.

To find out if AIB suits your financial goals, visit our dedicated article on AIB Personal Loans and learn more about this trusted alternative.

Related Content